- Sales Tax Renewal

- Homepage

-

What will the County spend the sales tax renewal funds on?

Public Safety

-

Sheriff Vehicles

-

Sheriff West Command Center

-

Public Safety Facility Upgrades

-

Emergency Communication System - Radio Towers & Equipment

Transportation

-

Improve Roads & Bridges

-

Improve Intersections

-

Pedestrian Safety Improvements & Trails

Parks & Recreation Infrastructure

-

Acquire Park Property

-

Development of New Parks

-

Improvements to Existing Parks

Stormwater Improvements

-

Drainage Improvements

-

Water Quality Improvements

-

Lake & Waterway Restorations

Stats

- This referendum does not raise taxes. The original levy was approved in September 1990 and renewed in 2005. The current levy sunsets August 31, 2025.

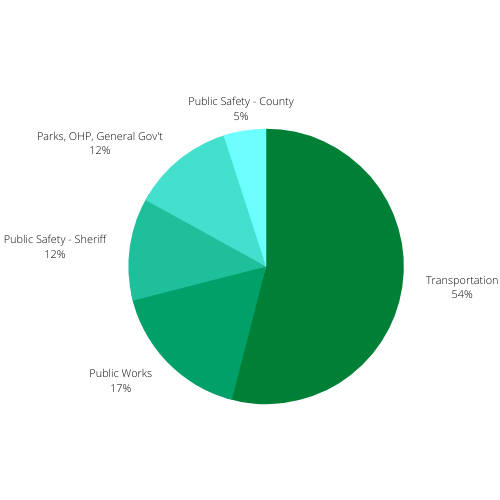

- Revenue from Osceola County’s portion of the one-percent sales tax is used to invest in local infrastructure improvements, such as Transportation improvements, Public Safety, Stormwater and Parks & Recreation

- Almost 50% of the sales tax is paid by non-residents

- Every dollar generated by the sales tax is spent in Osceola County.

- To generate same income, property taxes would have to increase by 26%

-

-

A few examples of the largest investments made using the sales tax:

- Sheriff Vehicle Replacement - $33.4m (Actuals and Programmed)

- Neptune Road Widening - $24.5m

- Partin Settlement Gov. Complex - $21.4m

- 800 MHz System Upgrade (Phase 1 & 2) - $19.1m

- Sheriff's Facility - $13m plus $6m

- Poinciana Blvd. (Phase 1) - $11.5m

- Fire/EMS Equipment - $11.1m

- Agricultural Center Complex - Ext. Services & KVLS - $10.4m (Combined)

- Kissimmee Park Rd. - $10.4m

- Sheriff Training Facility - $9.4m

- Narcoossee Rd. - $7m

- Complete Street Projects - $21.2m reserved of that $10m for Simpson Rd.

-

What has the infrastructure sales surtax done for the County?